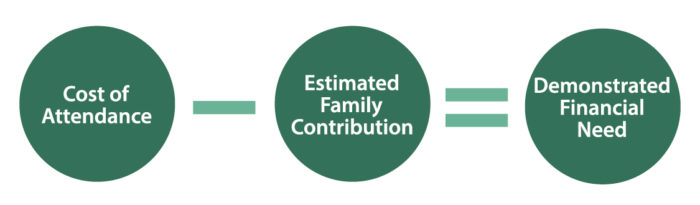

Demonstrated Financial Need

Financial aid at Scripps College is awarded on the basis of the institutionally determined demonstrated financial need, which is the difference between the costs of attendance and the amount your family is expected to pay: your expected family contribution, or EFC under our institutional formula. Scripps College meets 100 percent of this demonstrated need for all admitted students who meet all eligibility criteria and established application deadlines.

Cost of Attendance:

Educational expenses for the academic year include actual charges for tuition, standard fees, housing, food and an estimated allowance for books and supplies, transportation, and personal expenses, including average fees associated with federal student/parent loans (for those who borrow from those programs). Your actual cost of attendance may vary.

Please note that the estimated cost of attendance changes each academic year. Normally, the Board of Trustees will establish the rate of tuition and fees and housing and food for the upcoming academic year in their March meeting.

Estimated 2024-2025 costs for full-time, degree-seeking students

Cost Element |

On-Campus(Scripps Sponsored Housing) |

Off-Campus(Not w/Parents or Relatives) |

Off-Campus(with Parents or Relatives) |

Tuition and Fees |

$65,950 | $65,950 | $ 65,950 |

Housing and Food* |

$22,136 | $22,136 | $10,308 |

Books and Supplies |

$800 | $800 | $800 |

Personal Expenses |

$1,500 | $1,500 | $1,500 |

Transportation†* |

$500-$1,500 | $500-$1,500 | $500 |

Total Costs |

$90,886 – $91,886 | $90,886 – $91,886 | $79,058 |

*The allowance for food reflects the cost of the optional 19-meal plan that with flex dollars covers the cost of 3-meals per day. Financial aid will not be changed if you choose a plan with fewer meals or waive out of the meal plan entirely. Students living with parents or relatives have a food allowance but no housing allowance.

†*The transportation allowance vary by student based on the geographic location of their permanent residence.

The Claremont College Student Health Insurance Plan (SHIP) is not included total above, but may be added to your cost of attendance upon your request. For the 2023-2024 academic year, the SHIP premium is $2,996.

The 2022-20223 average Federal Direct Student Loan Fee of $41 will be automatically added to the cost of attendance for financial aid for those students who borrow federal student loans. If your parent(s) borrow a Federal Direct Parent PLUS Loan, the 2022-2023 average Federal Direct PLUS Loan fee of $1,327 will be automatically added to the cost of attendance for financial aid.

Estimated Family Contribution (EFC) & the Student Aid Index (SAI):

Scripps College Office of Financial Aid determines the family contribution by carefully reviewing each family’s financial aid applications including the FAFSA and CSS Profile forms, along with parent and student tax returns and supporting documentation. Scripps College uses both Federal Methodology(FM) and Institutional Methodology(IM) to determine your financial aid eligibility.

Federal Methodology (FM) is the formula used to determine eligibility for the Federal Pell Grant, Federal Direct Loans, Federal Work-Study, and state scholarship programs such as the Cal Grant. The federal Student Aid Index (SAI) is determined from the data provided on the Free Application for Federal Student Aid (FAFSA) and verified using data from federal tax returns and other supplemental documents. FM excludes some forms of income and expenses, and eliminates the primary residence asset from consideration, when calculating the SAI.

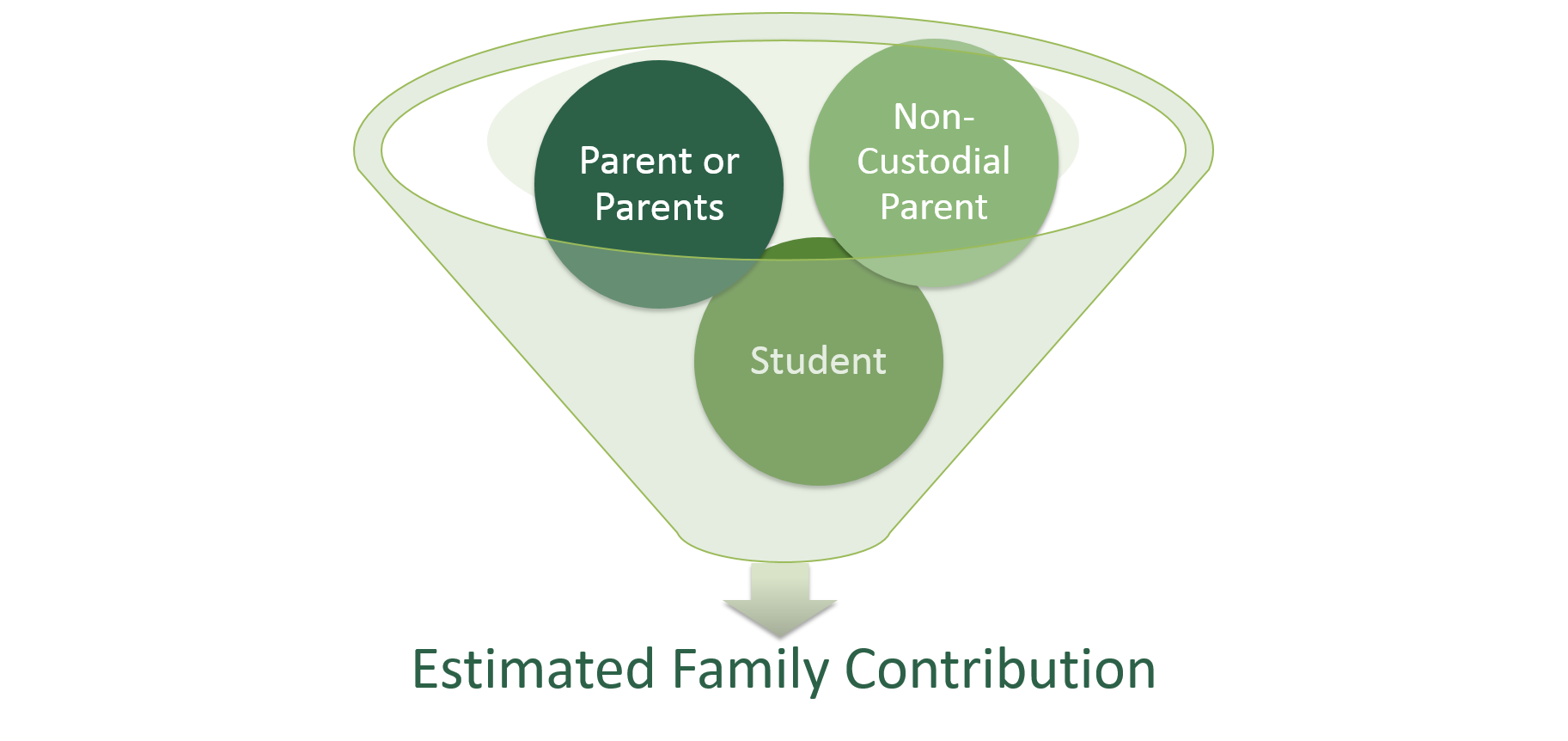

The Federal Student Aid Index (SAI) may be made up from a custodial parent contribution and a student contribution.

Institutional Methodology (IM) is a formula developed by the College Board used by over 400 colleges and universities in awarding institutional financial aid. Institutional Methodology determines your Estimated Family Contribution (EFC) includes several forms of income, asset, and expense elements not considered under Federal Methodology. We believe that this method of need analysis most accurately determines a family’s ability to pay for college.

Estimated Family Contributions may be made up from a custodial parent contribution, a noncustodial parent contribution, and a student contribution.

Parent Contributions (custodial parents and noncustodial parents)

The following items are considered:

- family size

- number of dependent children enrolled at least half-time in undergraduate degree programs

- parents’ income (including all forms of taxed and non-taxed income) and assets (including home equity, business equity, but not retirement accounts)

- extenuating family circumstances (such as illness or loss of employment)

Our need analysis allows for necessary family expenditures such as taxes, reasonable living costs (if you live in a more expensive area we have greater allowances for cost of living), educational savings for siblings and unusual medical expenses. Our analysis protects a portion of the family’s assets as allowances for emergencies and educational savings. Part of the remaining income and assets is considered to be available for current college expenses.

If a student’s biological or adoptive parents are divorced from each other, but either have remarried, they should be sure to include stepparent information on the FAFSA and/or CSS Profile applications.

Student Contributions

In addition to a parent contribution, each student’s personal income and assets are considered in determining a student contribution toward educational expenses. The minimum student contribution from income of $1,700 each year for books, travel, and/or personal expenses and a portion of personal savings or assets. The expectation is that the student will earn this amount in the summer preceding their the academic year. Alternatively, students and their families may cover this amount with outside scholarships, savings, parental assistance, and/or other financing options if they choose to.

Net Price Calculator

Use our interactive Net Price Calculator for an estimate of how much financial aid you may be eligible to receive and what your overall cost to Scripps College could be.

The Net Price Calculator requires information about your income, taxes, and assets as well as family size and number in college. The Net Price Calculator is not a financial aid application, but can help you better understand what assistance might be available to you. Click below to access the calculator.

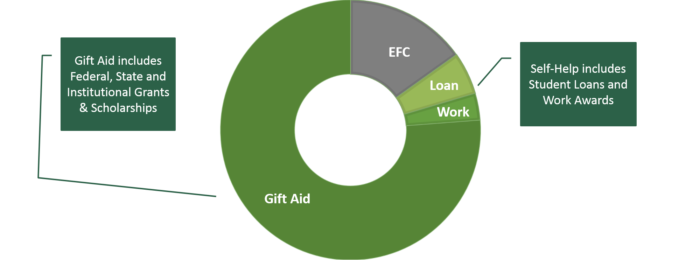

The Financial Aid Package

Once the family’s financial contribution has been determined, Scripps awards a combinations of grants, loans, and work-study to meet the student’s financial need. Eligibility for the federal aid is based on the Student Aid Index (SAI). Outside scholarships and other financial assistance may be used to reduce the minimum student contribution from income and self-help awards (i.e., loans and work) before they reduce Scripps College Grants.

Financial Aid for Future Years

Students and families must re-apply for financial aid each year. If the family’s financial circumstance remain relatively stable from year to year, the Estimated Financial Contribution (EFC), the Student Aid Index (SAI) and the amount of financial aid should remain fairly stable. If a family’s financial circumstances change from year to year (i.e., changes in income, changes in assets, changes in number of siblings who are undergraduates in college), then the EFC and SAI will change. Please note that the SAI does not make an adjustment for the number of dependent students in college.

Families should note that the cost of attendance will change each year. Historically, this change has been approximately 3 to 4 percent each year. In addition, the maximum annual amount of need-based student loans you will receive in your financial aid award will change each year. We cannot guarantee your financial aid award will not change in future years; however, for families whose financial circumstances do not change year-to-year, the amount of need-based grant aid will generally remain the same or increase slightly.

If a domestic student’s family experiences a change in circumstance during the academic year, the student should contact the Office of Financial Aid for more information.

Special Circumstances in Need Analysis

If your parent(s) owns a business, a farm, a partnership or a corporation, you may be asked to provide copies of their business tax returns for each separate entity. Many parents have Sole Proprietorship or LLC which may reported on IRS Schedule C. Some parents have rental properties that are reported on IRS Schedule E. Farms are often reported on IRS Schedule F. If your parents have an IRS Schedule C, Schedule E, or Schedule F, they should include it when they submit their federal tax returns.

If you parent owns part of a partnership, an LLC, or a corporation that reports income or losses on page 2 IRS Schedule E, you must also provide a copy of all of their K-1 statement(s). Additional documents such as business tax returns may be requested after review.

Both the business equity and income derived from the business will be considered in the determination of your Estimated Family Contribution under our institutional methodology and your Student Aid Index (SAI) under federal methodology. While all business losses and expenses will be considered in the determining the Student Aid Index (SAI) under federal methodology, Scripps College will exclude certain business expenses and losses from our analysis. In most cases, business income refers to the owner’s share of taxable income before IRS deductions for depreciation, vehicle expenses, travel, meals, and business use of your home. These deductions and Net Operating Losses (NOL) on the tax return are considered as part of the family’s untaxed income in our need analysis.

Financial responsibility for education does not end due to divorce or separation of a student’s parents. Generally, financial information from both parents is used to determine financial need, even if they are divorced or separated. Students whose parents are divorced or separated must have both parents complete their own CSS Profile application. Divorced parents who are remarried should also provide stepparent information on the FAFSA and CSS Profile applications. Under certain limited circumstances, students may appeal to have the PROFILE requirement for the noncustodial parent waived. Additional documentation of the circumstance will be required.

For students whose parents are divorced or separated, the Custodial Parent on your FAFSA will be the parent who provides you with the most financial support and will no longer be the parent with whom you lived with the most over the past 12 months.

The institutional calculation of the Expected Family Contribution takes into consideration the financial burden placed on a family when more than one dependent is attending at least half-time in an undergraduate degree granting program at the same time. For this reason, Scripps will require students to submit a Sibling Enrollment Verification Form each year if your financial aid award has been based upon having two or more students in college. Should your sibling enroll at less than half-time, withdraw, change school type (e.g., private 4-year, public 4-year, public 2-year), or graduate from their undergraduate degree program while you are enrolled at Scripps, your current and future financial aid awards will be recalculated to reflect this change.

Although you are still asked about the number of siblings in college on the FAFSA, this will no longer be considered in the federal formula for federal financial aid programs. As a result, your eligibility for those programs may change from prior years.

Financial assistance for international applicants is limited. Financial aid for international students is only awarded at the time of admission. Your aid offer will be renewed each year for up to 8 semesters as long as you enroll full-time and make Satisfactory Academic Progress toward your degree.

Financial aid is not re-evaluated for international students. Since your EFC is fixed upon admission, your financial aid award in future years may adjust slightly with the change in cost of attendance. The CSS Profile is required for international students who wish to be considered for financial aid. International students are also required to submit a professionally translated copy of their and their parents most recent tax documents or statement of earnings, and a Scripps College International Student Financial Form