Special Circumstances in Need Analysis

If your parent(s) owns a business, a farm, a partnership or a corporation, you may be asked to provide copies of their business tax returns for each separate entity and a copy of their K-1 statements.

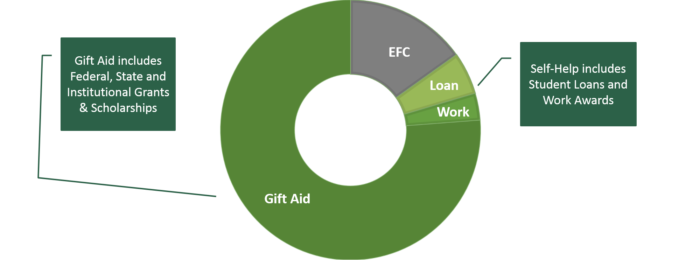

Both business equity and income from the business will be considered in determining your Estimated Family Contribution and Student Aid Index. Scripps College may exclude certain business expenses and losses from our analysis.

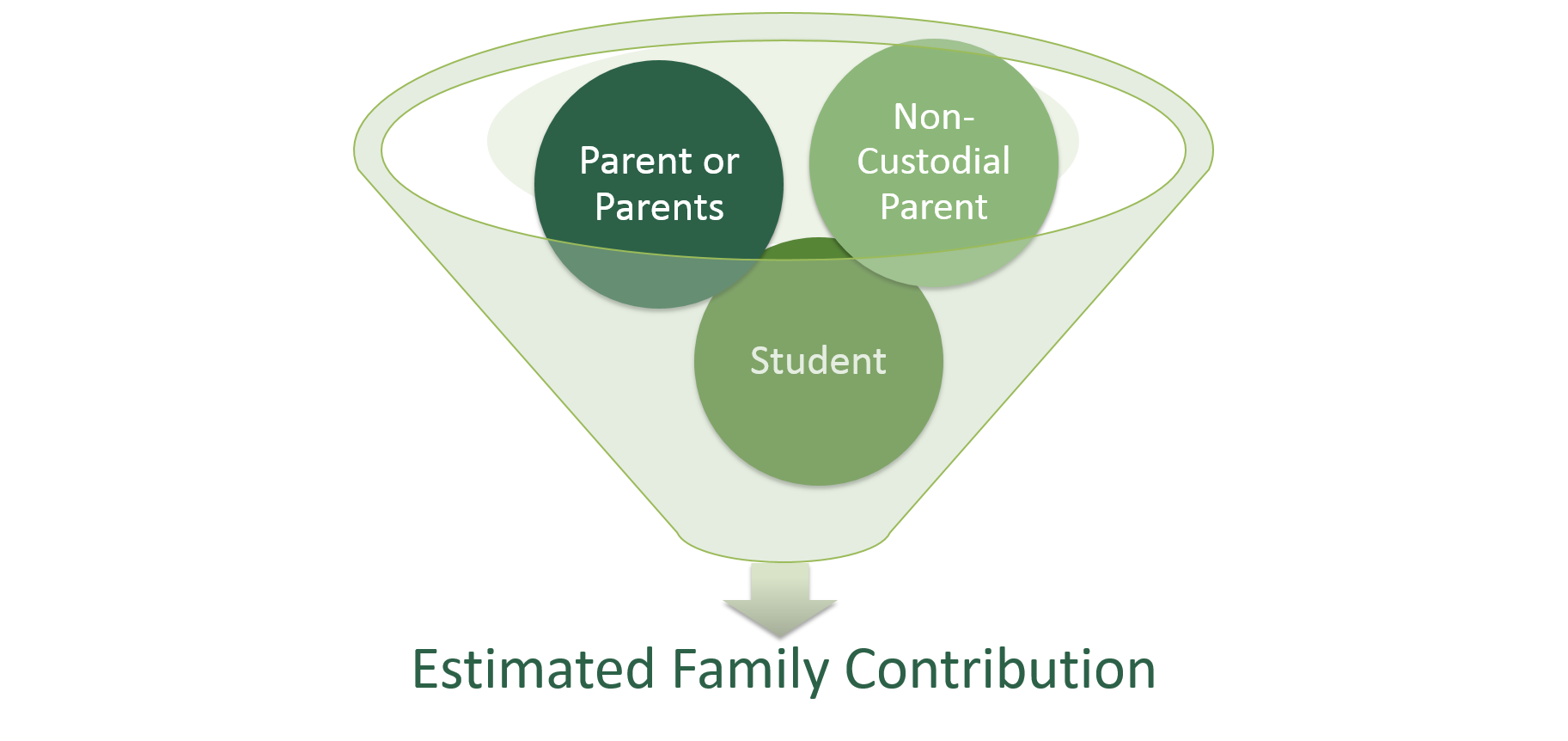

Financial information from both parents is used to determine financial need, even if they are divorced or separated. Students whose parents are divorced or separated must have both parents complete their own CSS Profile application. Divorced parents who are remarried must include stepparent information on the FAFSA and CSS Profile. Under limited circumstances, students may appeal to waive the noncustodial parent requirements. Additional documentation will be required.

For students whose parents are divorced or separated, the custodial parent on your FAFSA will be the parent who provides you with the most financial support.

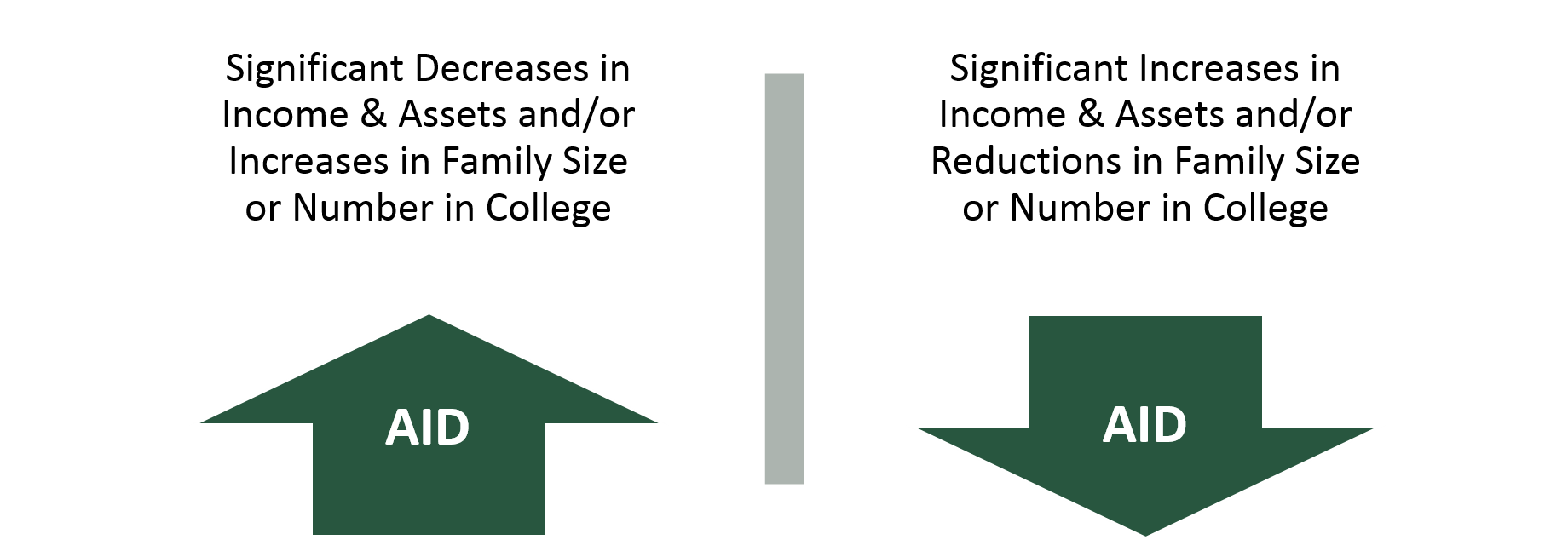

The institutional calculation takes into consideration the financial burden placed on a family when more than one dependent is attending, at least half-time, an undergraduate degree granting program at the same time. Scripps will require students to submit a Sibling Enrollment Verification Form. Should your sibling enroll less than half-time, withdraw, change school type, or graduate from their undergraduate degree program while you are enrolled at Scripps, your current and future financial aid awards will be recalculated to reflect this change.

Financial assistance for international applicants is limited and awarded at the time of admission. Your aid offer will be renewed each year for up to 8 semesters as long as you enroll full-time and make Satisfactory Academic Progress toward your degree.

Your EFC is fixed upon admission and your financial aid award in future years may adjust slightly with the change in cost of attendance. International students interested in applying for financial aid must complete the CSS Profile, submit a translated copy of parent tax documents or earnings statements, and the Scripps College International Student Financial Form