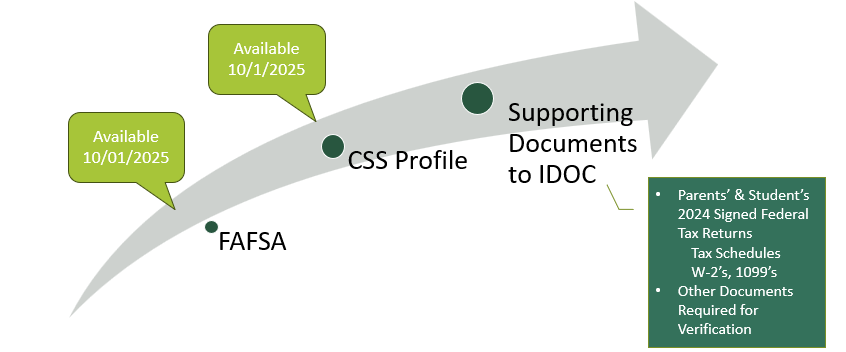

2026-2027 Financial Aid Applications and Materials are available October 1, 2025

Financial Aid Application Deadlines

All prospective students who wish to be considered for Scripps College need-based financial aid MUST meet all published financial aid application deadlines. Scripps College is need aware in our admission process. If you do not submit a complete financial aid application by the published deadline, you may not qualify for financial aid.

First-Year Applicants

Fall 2026 Early Decision I

All applications and supporting documents must be submitted to IDOC by November 15, 2025

Fall 2026 Early Decision II

All applications and supporting documents must be submitted to IDOC by January 31, 2026

Fall 2026 Regular Decision

All applications and supporting documents must be submitted to IDOC by January 31, 2026

Transfer Students

Spring 2026 Transfer Students

All Applications and Supporting Documents must be submitted to IDOC by November 15, 2025

Fall 2026 Transfer Students

All Applications and Supporting Documents must be submitted to IDOC by March 14, 2026

Financial Aid Application Requirements

To apply for financial aid at Scripps College, complete the steps outlined below. Students interested in only receiving federal and state grant and loan assistance only need to complete the Free Application for Federal Student Aid (FAFSA). The CSS Profile is required to be considered for Scripps College institutional grants.

Complete the Free Application for Federal Student Aid (FAFSA)

- The 2026-2027 FAFSA is available as of October 1, 2025.

- Scripps College FAFSA School Code: 001174

- This form should be completed by US citizens, permanent residents, and other eligible non-citizens only.

- California residents eligible under the California Dream Act(AB540) should complete a CA Dream Act Application in lieu of a FAFSA.

- California residents must file a FAFSA by March 2, 2026 to be considered for state aid.

- If your parent(s) have remarried, include all stepparent income and asset information.

- For students whose parents are divorced or separated, the Custodial Parent on your FAFSA will be the parent who provides you with the most financial support. For more information, check Is My Parent a Contributor When I Fill Out My FAFSA?

Complete the CSS Profile

- Scripps College CSS Profile School Code: 4693.

- Students with divorced or separated parents:

- Each parent will complete their own CSS Profile, using individual log-in credentials.

- If your parent(s) have remarried, include all stepparent income and asset information.

- Under certain circumstances, students may appeal to have the CSS Profile requirement from your noncustodial parent waived by completing the Noncustodial Parent Waiver Form. Additional documentation will be required.

- Report your Social Security number correctly on the CSS Profile to avoid processing delays.

Use the College Board’s Institutional Documentation Service (IDOC) to submit your supporting documentation. To ensure your data privacy, the Office of Financial Aid discourages students and parents from submitting documents with Personally Identifiable Information (PII) (e.g. social security numbers and date of birth) via email. Instead, all students and parents should submit via IDOC as it will securely transfer images to the college.

- When you complete the CSS Profile, you will receive a notification directing you to submit your required documents to IDOC.

- You must submit the following:

- Signed Copies of Parent(s) 2024 Federal Tax Returns including all tax schedules, W-2 and 1099 forms.

- Non-Tax filers must include all W-2 forms and the 2026-2027 Parent Non-Tax Filer Statement

- Signed Copies of Student 2024 Federal Tax Return including all tax schedules

- Signed Copies of Parent(s) 2024 Federal Tax Returns including all tax schedules, W-2 and 1099 forms.

- All parent business owners or partners are asked to submit:

- Schedule 1, Schedules C, and/or Schedule E, along with K-1 schedule(s) for each corporation or partnership.

After November 17, 2025, check the Financial Aid Checklist in your Admission Applicant Status page to ensure all documents have been submitted.

- Documents submitted to the IDOC website may take 7-10 business days to be processed and appear in your Financial Aid Checklist.

- The Financial Aid Checklist will be updated daily. You may find that additional documentation is required based on the information you provided.

- For students who submitted application materials during the winter break December 23rd -January 3rd, your checklist should be updated by January 15th.